US edtech companies hit paydirt in 2014, raising $1.36B in 201 rounds from more than 386 unique investors, according to analysis by EdSurge.

Yes, you read that right. Billion. With a “B.”

How does $1.36B compare to edtech funding in years past? A TechCrunch post from March of this year uses CrunchBase data to stake the total for 2013 at $1.31B. But this total includes international edtech deals, which our analysis omits (our 2013 total comes in at $1.2B).

The US edtech sector has had a record breaking year of investment in 2014.

Products for K12 Schools or Everything Else?

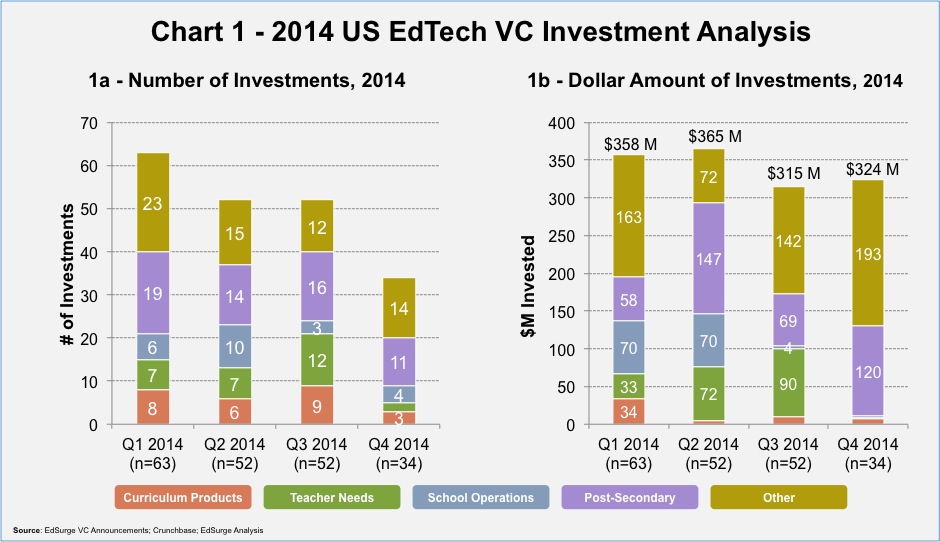

So where is all of that money flowing? To start, we broke down US edtech funding by our Edtech Index categories, looking at each quarter in 2014:

Interestingly, the number of total US edtech deals has fallen each quarter (see Chart 1a), from a high of 63 in Q1 to just 34 in the (still incomplete) fourth quarter. This trend bucks that of 2013, when deals were spaced out relatively evenly throughout the year. On the other hand, the number of dollars invested in US edtech was relatively consistent throughout 2014, with each quarter amassing between $315M and $365M in investment (see Chart 1b).

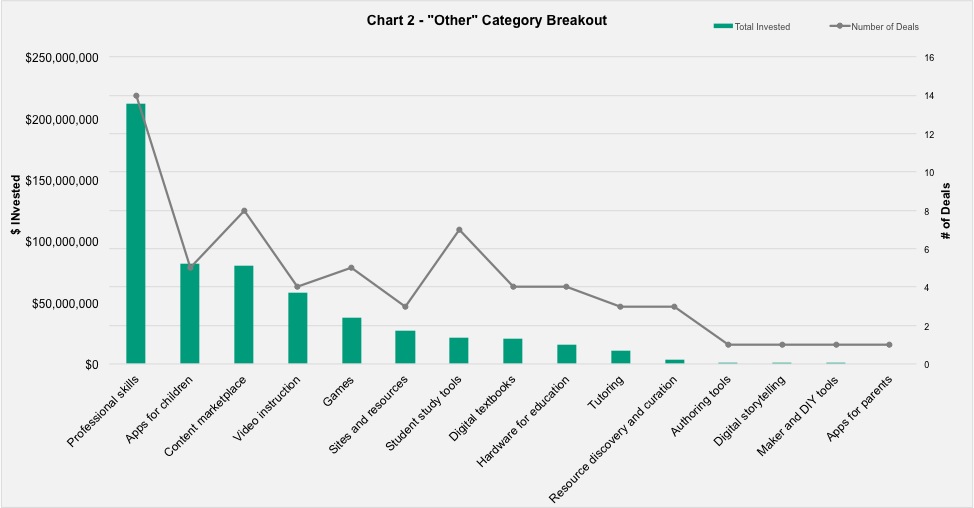

Let’s start with the largest subsector of our Edtech Index,"Other" [1]. As seen in the next chart, over a third of the nearly $570M brought in by “Other” products went to products for professional skills: Companies that work with employers or directly with students to teach skills needed in the professional world. Compared to US K12 companies, the businesses in the “Other” category face different sets of scaling obstacles, the kind that can be more like B2B SaaS (business-to-business, software-as-a-service) products or consumer oriented apps. But compared to the US K12 sector, they also benefit from at least three important growth drivers:

- Pervasive, high-quality hardware infrastructure (high speed wifi, 4G, wide range of hardware types and form factors, etc.).

- More integrated software stacks that connect different existing tools via services like IFTTT or Zapier

- Individualized professional development through decades of user communities (free and paid) with individual resources for every use case, error, or hack (need Windows 3.1 support)?

Despite some promising efforts, the K-12 sector currently lacks these supports.

Of the $212M invested in professional skills companies in 2014, $135M went to Utah-based Pluralsight, while the remaining 13 deals accounted for a combined $77M.

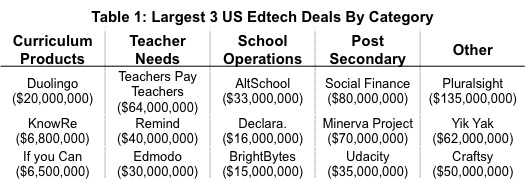

Pluralsight’s mega Series B also made it the largest edtech deal of the year (see Table 1 below). Combined, the “Other” and “Post-Secondary” categries accounted for five of the six largest US deals in 2014. TeachersPayTeachers rounds out the top 6, with its $64M investment leading the way among Teacher Needs. Duolingo’s $20M Series C raise and AltShool’s $33M round may look small compared to the big money put up by Pluralsight or Social Finance, but the deals were big enough to lead the Curriculum Product and School Operations categories, respectively.

Where is the Investment Coming From?

As noted above, over 386 unique investors put money into edtech companies in 2014. Chart 3 shows our count of the 11 most active investors in US edtech in 2014. Many of these organizations come as no surprise; accelerators Techstars and 500 Startups spread their investment among many new companies, including those in edtech. NewSchools Venture Fund, LearnCapital, Rethink Education (and Owl Ventures if you include the investments those partners made as part of their previous roles at Catamount Ventures) constitute a decently sized and growing set of early stage investors focused deeply on edtech.

General tech investors also put money into edtech this year; GSV Capital, First Round Capital, and Kapor Capital all were in on the action. Though none specifically focuses on edtech, many, like the Bill & Melinda Gates Foundation, focus on investments they see as bringing long term benefits to society. [2]

Will this Investment Continue?

And so we come to the question in the minds of edtech entrepreneurs, investors and users alike: Will the investment bonanza in edtech continue? We at EdSurge believe that this is actually two different questions. The first is, “Will early stage (seed and Series A) funding continue to grow over time?”

From our perspective, the answer o this first question is likely “yes.” As non-edtech focused VC’s continue to dip their toes into the edtech world, the amount of funding available to early stage edtech companies should increase. This robust funding landscape in turn drives company creation, along with general tech industry tailwinds like lower startup costs and the growing support structure for entrepreneurs.

The second, more difficult question then becomes, “How many of the companies looking for Series B money will succeed?”

Our prediction is that this move is going to be a challenge for the edtech sector. At early stages, edtech entrepreneurs can rely for investment on some combination of the promise of a large universal set of customers and needs, socially conscious angels, initial viral growth and some evidence from schools of a willingness to pay for the product. Entrepreneurs can “sell the dream.” In a Series B round or later, investors need to see real growth. Growth in edtech is difficult, for the reasons mentioned above as well as many others.

One way to get some perspective is to look at the ratio of companies receiving Series A funding to those receiving Series B funding. The evidence available suggests that edtech companies are or will very soon be having trouble making the jump from Series A to Series B. In the overall VC market between 2012 and 2014, the ratio of Series A to Series B investments was between 1.97 and 1.71: There were about two Series A investments for every Series B (see Chart 4). In contrast, edtech’s ratio reached as high as 4.0 in 2012, and has held steady at just under 3.0 for the past two years.

This trend suggests that there are likely to be edtech firms--perhaps a lot of edtech firms--that will not be able to raise the necessary Series B to scale their operations. Enter, consolidation. It is likely that the industry will see a wave of acquisitions, mergers and pivots over the next couple of years, as companies with high quality products but an uncertain path to sustainability are forced to exit the market with another set of opportunities and challenges.

Or maybe edtech investors put a greater share of dollars to work? Tipping points for growth at the school or district level are emerging. Hardware and software is improving. Users and user communities are growing. This change is happening at a very slow pace relative to other sectors, but it is happening. 2014 has been a very good year for edtech. In 2015 and beyond we will see whether today’s seed recipients can make the jump from startups to sustainable companies.

[1] The “other” category includes products who are not focused on K12 or post-secondary curriculum, teacher/professor needs, or school operations

[2] Note: The Bill & Melinda Gates Foundation, NewSchools Venture Fund, GSV Capital and Learn Capital are investors in EdSurge