Even the biggest names in the education technology industry, awash in private capital, are seeking public support during the pandemic.

School districts are hardly the only ones in education under financial duress inflicted by COVID-19. Also feeling the ripple effect are the companies and organizations that provide tools and services to students and educators.

Like their peers in other industries, many private education companies and organizations applied for support from the Payroll Protection Program (PPP), which provides federal loans to help organizations keep employees on payroll and stay in business. Loans are forgiven provided that recipients meet criteria that include using at least 60 percent of the amount to keep their staff while maintaining at least 75 percent of their current salaries.

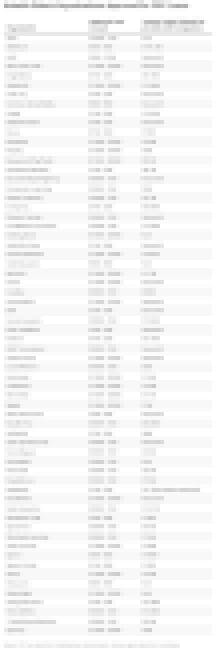

Last week, the Small Business Administration and the U.S. Department of the Treasury released data on 660,000 companies and nonprofits that were approved for over $150,000 in PPP funding. Among the recipients in the education sector are private K-12 schools, colleges and universities, charter school operators, professional development organizations, technical and trade schools, and test-prep centers.

A review of the data by EdSurge for notable education technology software and service providers found more than 60 for-profit and nonprofit organizations that were approved for a loan between $150,000 to $5 million. (ISTE, the parent organization of EdSurge, was also approved for a PPP loan.)

And though the program was designed to help small businesses, some education organizations approved for loans have previously raised hundreds of million from private backers. Even an investment firm that has supported dozens of edtech startups appeared on the list.

Pitchbook, a market research firm focused on private capital markets, found more than 8,100 companies on the list that had raised capital from venture capital and private equity firms. That amounts to a little more than one percent of the 660,000 organizations approved for a loan of at least $150,000.

Still, privately funded companies have faced criticism for taking loans as “free money” to simply extend their financial runway. Investors themselves are also split over whether internet startups should take advantage of an essential lifeline targeted toward local mom-and-pop shops that operate in-person businesses without venture capital support or connections.

“When considering applications for forgivable loans under the Paycheck Protection Program, we encouraged our portfolio companies’ leadership teams to engage in reflection and discuss whether it was appropriate, if they had not already done so,” said Jennifer Carolan, co-founder of edtech investment firm Reach Capital, in an email. “For many, these discussions continued at the Board level. We witnessed thoughtful consideration of their employees’ needs, their values and the greater context of this crisis. In the end, very few companies applied.”

Venture-backed or not, the fact that education companies applied for the program “does not surprise me,” says Sandro Olivieri, who runs Productive LLC, a strategy consulting firm for impact-investment programs. In April, he surveyed education businesses about how the pandemic impacted their operations. Of the 104 companies that responded, more than 60 percent said their financial runway had shortened, and 71 percent projected a decrease in sales. More than a quarter had already laid off employees.

“When school closures started happening, edtech companies started hurting for cash. Their sales pipeline was impacted, their outlook for the fall changed and it drastically reduced their runway,” says Olivieri.

Funding for Big Fishes

Among venture-funded edtech companies that received a PPP loan, Altitude Learning has raised the most capital. Formerly known as AltSchool, the company had secured more than $176 million before it significantly retrenched its operations last year and rebranded to its current name. The San Francisco-based company, which now offers an online education platform to schools and families, was approved for a loan between $2 million to $5 million.

Sphero started as a consumer robotics toy company and later refocused its business on the education market. It has raised $148 million from investors—and was also approved for a loan between $2 million to $5 million.

RaiseMe, a provider of an online scholarship platform for high school students that previously raised $31.5 million, was also approved for a PPP loan in April. A couple months later, the San Francisco-based startup was acquired by CampusLogic. (RaiseMe declined to comment about whether it had used those funds.)

The list also includes several high-profile nonprofit edtech organizations that have received millions in support from philanthropic donors. They include Khan Academy, which was approved for a loan in the same amount range as Altitude Learning and Sphero.

Khan Academy CEO and founder Salman Khan told EdSurge in April that traffic spikes to its website could triple its server costs. Already the nonprofit has received $3 million in grants from AT&T, Google and other corporate donors earlier this year. In an interview with Mountain View Voice last week, he said the PPP funds helped the organization keep its 180 employees.

Code.org, a nonprofit that provides and advocates for computer science education programs in K-12 schools, was approved for a $1 million to $2 million loan. Over the years it has received about $100 million in philanthropic funding, largely from major Silicon Valley technology companies.

Min Yoo, director of marketing and development at Code.org, said the loan will be used to retain its current staff of about 80 employees. The pandemic has forced the team to cancel its in-person professional development programs, and focus on creating online resources for students and teachers.

“The economic impact from COVID-19—particularly related to fundraising for programs and operations—was and still is quite uncertain. This loan helps mitigate this risk and support unexpected operational adjustments in response to the changing K-12 landscape,” she said in an email.

Supporting Small Businesses

Not all private edtech recipients are as well endowed; many have raised much less in private capital, with a staff and footprint befitting the sort of small businesses that the program aimed to help.

Among the smaller-sized PPP recipients are companies like Listenwise, which provides online lessons, activities and resources to help students build listening comprehension skills. The Boston-based startup applied for the PPP loan the first day applications were open, on April 3, according to its co-founder and CEO Monica Brady-Myerov.

That decision was driven in large by uncertainty over how long COVID-19 would disrupt its business. School closures unfolded at the start of the typical procurement cycle, when officials usually plan what to buy for the following school year. In most districts, purchasing decisions and budgets are finalized from April to June, and the actual purchases happen over the summer.

The pandemic “turned the sales cycle a bit on its head,” says Brady-Myerov. “We knew there would be delays in purchasing decisions from customers.”

Like many other education companies, Listenwise made all its offerings available for free for the rest of the 2019-2020 school year as the pandemic hit. Nearly 10,000 teachers took up the offer, but it remains to be seen how many will be paying subscribers for the upcoming school year, according to Brady-Myerov.

She says the company received $170,000 in PPP funding, which has allowed Listenwise to maintain its team of eight full-time staff at current salaries.

Education investors themselves have also been approved for PPP loans. GSV Acceleration, a funder of over two dozen edtech companies, was approved for a $150,000 to $350,000 loan.

LearnLaunch, a Boston-based nonprofit, was also approved for a loan in that range. The organization hosts events and operates a co-working space for education companies, and is affiliated with an edtech business accelerator program that shares the same name (but which operates as a separate entity).

In an email, Jane Swift, president and executive director of LearnLaunch (and former Massachusetts Governor) said the decision to apply for PPP loans was due to “the uncertainty around our operating model, the closure of our co-working space which created significant financial losses and our commitment to continue to support the education ecosystem.”

LearnLaunch has reduced or forgiven rent for startups that used its co-working space. But it does not own that space. “We have continued to make rent payments to our landlord, McGraw-Hill Education, at a significant financial loss to the organization,” Swift said. Her team has also canceled all of its revenue-generating events for the rest of the year. Its next annual conference, scheduled for January 2021, is up in the air, she added.

Swift said the PPP funds has allowed LearnLaunch to not only keep its staff of eight, but also convert two of its consultants to full-time employees in August. “As our work with school districts has increased we are slowly beginning to increase our headcount as we are financially able to do so in a responsible manner.”